[embedyt]https://www.youtube.com/watch?v=OaKCbx0VgpY&width=800&height=450[/embedyt]

H

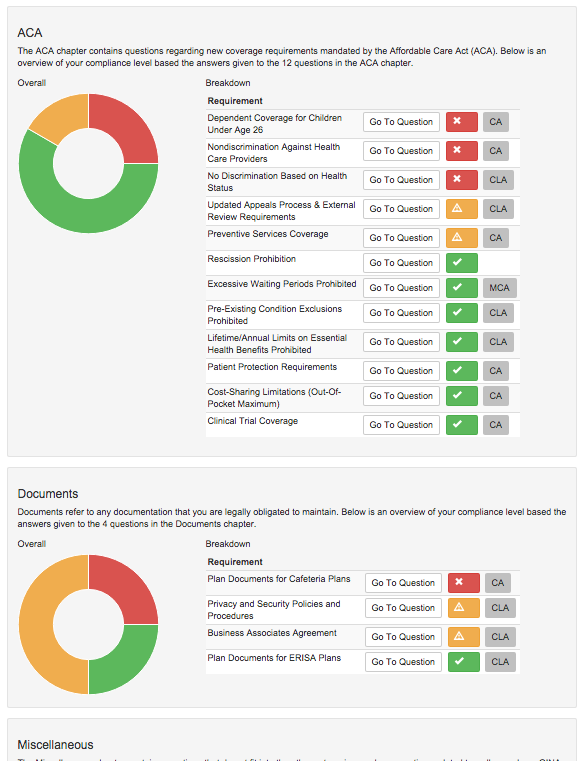

SelfCheck gives brokers and consultants a powerful tool to help analyze an employer’s compliance with important employee benefits rules. The system guides you through a comprehensive series of questions and produces a detailed report identifying compliance gaps.

Compliance Areas Covered:

Employee Disclosures:

ERISA, ACA, COBRA, HIPAA, Medicaid, Medicare, WHCRA, Michelle’s Law, Wellness Programs and more

Government Reporting Requirements:

ERISA, W-2s, ACA section 6055/6066, Medicare Part D

Applicable Fees:

PCORI, Reinsurance, ACA Section 4980H, Cadillac Tax, Medicare Tax

Health Care coverage requirements

Other miscellaneous compliance requirements:

Wellness plans, Dependent coverage, Nondiscrimination, GINA and more

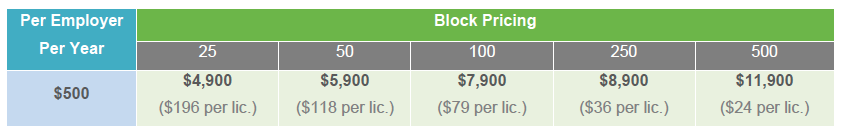

Pricing*:

*Further discounts are available for Benefit Comply Retainer Clients and affiliates of partner associations.